Silver and Gold Market Price ForecastI think that buying silver today is like buying gold for $554 an ounce. Let me explain: As I am writing, silver is currently trading at about 65.2% (32.6/50) of its 1980 high. If gold was trading at 65.2% of its 1980 high, it would be trading at $554 (0.652*850).

Now, I really like gold, even at today’s price of $1 738, but why should I pay $1 738, if I can get it for $554 by buying silver and then exchanging it for gold when the gold/silver ratio is at an extreme (in favour of silver). The reason for this logic comes from the fundamental relationship between gold and silver as explained in my previous article.

For my argument to be valid, silver has to outperform gold over my investment period, and at least equal gold’s performance relative to its 1980 high. That is, for example, if gold reaches five multiples of its 1980 high ($4250), then silver should do the same ($250), in this example, giving us a gold/silver ratio of 17.

Now, if silver outperforms gold, then that means that the gold/silver ratio should decline over my investment term. In my previous article called: Why Silver for a Monetary Collapse, I analysed the gold/silver ratio from a very long perspective (200 years). Here I would like to take a slightly more short-term view (40 years).

Below, is a long +/- 40 year chart of the gold/silver ratio:

On the chart, I have identified two fractals, which I have both

marked with points 1 to 3. The two patterns are visually very similar. I

have indicated two option of where we could be currently (on the

current pattern), compared to the 70s pattern. The ratio appears to be

at a major crossroads, ready to make a big move, up or down. This could

mean that a massive move in the gold and silver price is due shortly.

Based on the patterns, if it moves up, it would likely signal the end

of the precious metals bull market, similar to January 1980. A move

down would be an acceleration of the current bull market in gold and

silver, similar to August/September 1979.

The question is therefore: Do you think the bull market in precious

metals is over? Before you answer that, first consider the following:

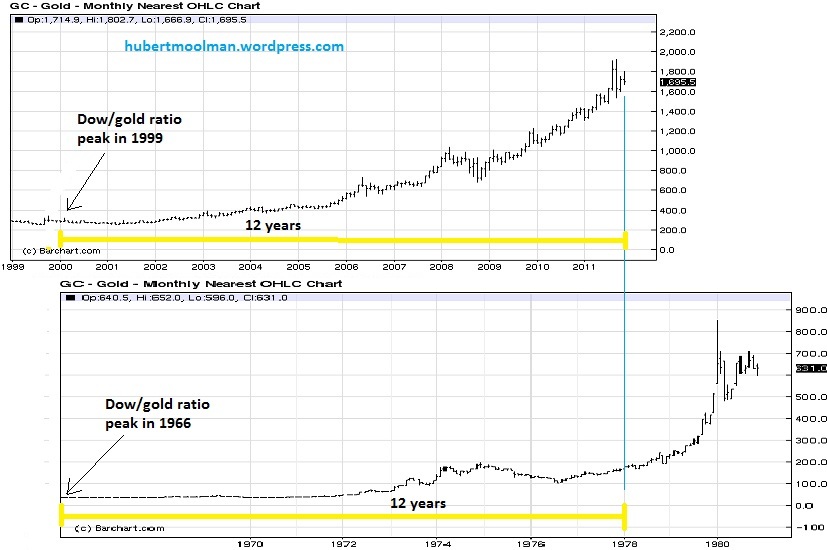

On the above graphic, the top chart is the current gold bull market

from 1999 to date, compared to the bull market of the 60s and 70s, the

bottom chart. The previous bull market in gold was about 14 years long,

from a peak in the Dow/gold ratio to the bottom in Dow/gold ratio. The

current bull market is 12 years, from the peak in the Dow/gold ratio to

date.

The previous bull market ended with a parabolic move in gold (on the

above scale). The current bull market has not made a parabolic move (on

the above scale); in fact, it has been rising steadily over the last 12

years.

To me, these two charts suggest that we are more likely to have a

parabolic rise in the gold price, than being at the end of this bull

market. Therefore, it also suggests that price action for gold and

silver, and the gold/silver ratio is likely to be more like 1978/1979

than like January 1980.

So, back to my argument of buying silver, in order to get gold at

$554: I certainly think that silver will outperform gold over the

remaining part of this bull market in precious metals, as well as, at

least equal gold’s performance relative to its 1980 high. I can

certainly see how gold could be at $4250 with silver being at $250, or

at higher prices, with the gold/silver ratio being at 17 or less.

For more analysis on

silver and

gold, you are welcome to subscribe to my

free or

premium service.

Warm regards and God bless,

Hubert